SUBJECT:

I have been depressed lately, feeling that I’m missing out on something important. After several sessions with my psychiatrist she said I had a psychosis caused by not owning gold assets. She prescribed some benzodiazepine, but told me under no circumstances to buy gold. With all the media hype about owning gold, and lately, all the reasons to own gold – inflation, war, deficits, etc., etc. – and me not owning gold, was definitely the cause of mental sickness. The medication is working well, however, she never told me her reason(s) not to buy gold. I was on my own! So, I pulled out all my charting tools to research gold’s past and present performance. By God, she was right!

COMMENTARY:

The bottom line is that the dollar and gold are highly inversely correlated assets. When the dollar goes down, gold goes higher and vice-versa, almost every time. Look no further than the first chart (GLD vs UUP), below:

Rectangular highlights clearly demonstrate this relationship from 2016 to the present time. GLD reached an all time high (ATH) on August 3, 2020 as indicated by the yellow line and has lost 8.32 percent since then as the UUP meandered. On Friday, the dollar down-ticked a bit, but gold more so.

The ATH is an extremely important trading indicator independent of the dollar/gold inverse relationship. See the second chart, below, titled “Weinstein Stage IV down-trend in GLD” where the ATH of August 3, 2020 is shown as a green line:

/

/

/

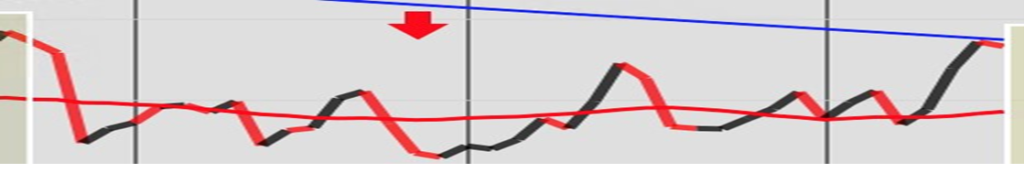

For purposes of identifying a Weinstein Stage IV down-trend, note the red line — the 30-day simple moving average (DMA) crossing the chart. On August 9, 2021 see that GLD’s price crossed below the 30 DMA and went lower the following week. Such could be the beginning of a “Weinstein Stage IV” decline, a signal that alerts traders to be ready to exit an equity(s) as the market trend may be going lower. That’s a paper for another day. Since August 9, 2021 GLD price has been tracking the 30 DMA:

The dollar (UUP) as well, since January 2021, has been tracking the 30 DMA:

This is further evidence that the UUP and GLD are highly inversely correlated.

Finally, see the third chart, below, titled Gold (USD/t.oz) which tracks the prior charts but is on a much longer term basis (going back to 1970) and prices gold as you hear about it in the news media – priced by the Troy ounce:

/

/

/

Because behavioral patterns are just as important as price itself, decide how you would have reacted in each of the following historical scenarios as you track each point on these charts:

You bought gold on September 1, 1980 at $666.75 per ounce, saw it lose 52% nineteen months later, on March 19,1982 when it priced at $315.75, and taking 25 years more years, until February 25, 2007, to get back your purchase price (priced at $682.44). Would you have held onto gold, realizing an actual “time value of money” loss of 40 percent ($667 became $400 if otherwise safely invested)?

If you held or bought gold on February 25, 2007 at $682.44 and continued to hold through the 2008 financial crisis when gold fell from $1,003 on March 14, 2008 to $732.45 on November 6, 2008, a loss of 27 percent over eight months, would you have continued to own?

Finally, if you bought gold on August 1, 2011 at $1,887.70 would you have held it through October 9,

2018 with a price of $1,187.20, a loss of 37 percent? If you did, your gain at gold’s ATH, $1,969.75 on August 3, 2020, was $82.05 per ounce after a holding period of nine years, a meager 4 percent return at gold’s ATH.

Honestly now, would you have held onto gold in any of these past decline periods? Going forward, why would gold deviate from past performance?

Now, you too are on your own. The brilliant people at www.marottaonmoney.com have consistently maintained that it’s never a good time to own gold as an investment. Now I know why. Check out a great site where I have harvested some of my data, www.goldprices.com Thoughtfully for your financial health and well-being, Dan Steele